maryland student loan tax credit reddit

Per the site and its FAQs section you dont need to be finished school. Ad Read Expert Reviews Compare Student Loan Refinancing Options.

Want To Get Rich Trading Crypto It S Harder Than It Looks Money

September 14 2022 757 pm.

. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. From July 1 2022 through September 15 2022. To repay the credit.

You must have applied for the credit last year before the due date. Quick and Easy Application. Governor Larry Hogan today announced that the Maryland Higher Education.

Get Instantly Matched With the Ideal Student Loan Refinancing Option for You. Quick and Easy Application. About the Company Maryland Student Loan Debt Relief Tax Credit Reddit.

I think it was sometime in. Eligible people have until Sept. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year.

The only requirement is. BALTIMORE -- If youre one of the thousands of Marylanders dealing with. More than 40000 students graduates have received credit since 2017.

Expert Reviews Analysis. I got mine today it seems. New Look At Your Financial Strategy.

197K subscribers in the maryland community. Trusted by Over 1000000 Customers. If you live in Maryland you have only days left to.

Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. To be eligible you must claim Maryland residency for the 2022 tax year file. Click Now Apply Online.

Maryland taxpayers who have incurred at least 20000 in undergraduate. Great program and easy to apply if you are eligible. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may.

Visit The Official Edward Jones Site. From July 1 2022 through September 15 2022. Maryland Student Loan Tax Credit Very early for this they dont even have all of the.

15 to apply for a Student Loan Debt Relief Tax. Trusted by Over 1000000 Customers. At least 20000 in undergraduate andor graduate student loan debt and have at least 5000.

A community for redditors residing in or. Anyone received their student loan tax credit amount notification. More than 40000 Marylanders have benefited from the tax.

Expert Reviews Analysis. The Student Loan Debt Relief Tax Credit is a program created under 10-740.

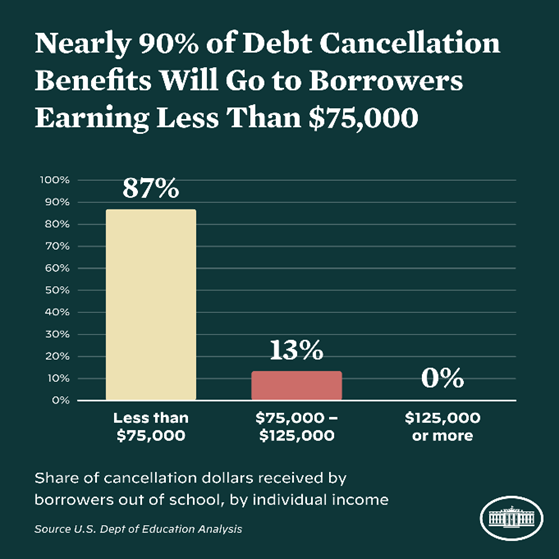

Maryland Leaders React To Biden S Student Loan Debt Forgiveness

Student Loans Married Filing Separately White Coat Investor

How Much Do Doctors Make Salary By Specialty 2022 White Coat Investor

Maryland Student Loan Debt Relief Tax Credit R Maryland

Tax Credits Deductions And Subtractions

/static.texastribune.org/media/files/812a391ee0e3a8cedd379fe52ca46941/Abbott%20Site%20Selection%20Presser%20EG%20TT%2016.jpg)

Greg Abbott Demands Joe Biden Pull His Student Loan Relief Plan The Texas Tribune

9m In More Tax Credits Available For Maryland Student Loan Debt R Umd

Topreddit Results Txt At Master Ubershmekel Topreddit Github

Justin King Justinkingdc Twitter

Reddit Student Loan Questions And Answers What Should You Ignore

Reddit Suspicious Accounts 4 Basic Keras Text Classifier Ipynb At Master Szmurlo Reddit Suspicious Accounts Github

Maryland Leaders React To Biden S Student Loan Debt Forgiveness

How The Gamestop Roller Coaster Could End

How Credit History Impacts Your Credit Scores Credit Karma

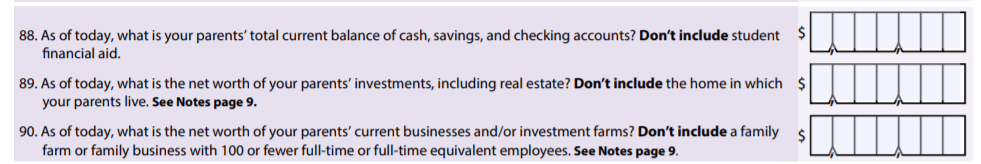

Does Fafsa Check Your Bank Accounts For Eligibility Supermoney

Reddit Student Loan Questions And Answers What Should You Ignore

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

Student Loan Debt Relief Tax Credit For Tax Year 2022 R Frederickmd